In recent years, the landscape of real estate investment has evolved in remarkable ways. A standout trend is the meteoric rise of mixed-use urban village REITs, which focus on properties seamlessly integrating living, working, and recreational experiences into singular, walkable environments. These innovative real estate investment trusts have garnered significant attention from investors and urban planners alike for their adaptability, resilience, and community-centric approach to modern urban life. Rather than isolating homes, offices, and leisure venues, these developments foster interconnected neighborhoods catering to the diverse demands of today’s city dwellers.

Redefining Urban Living

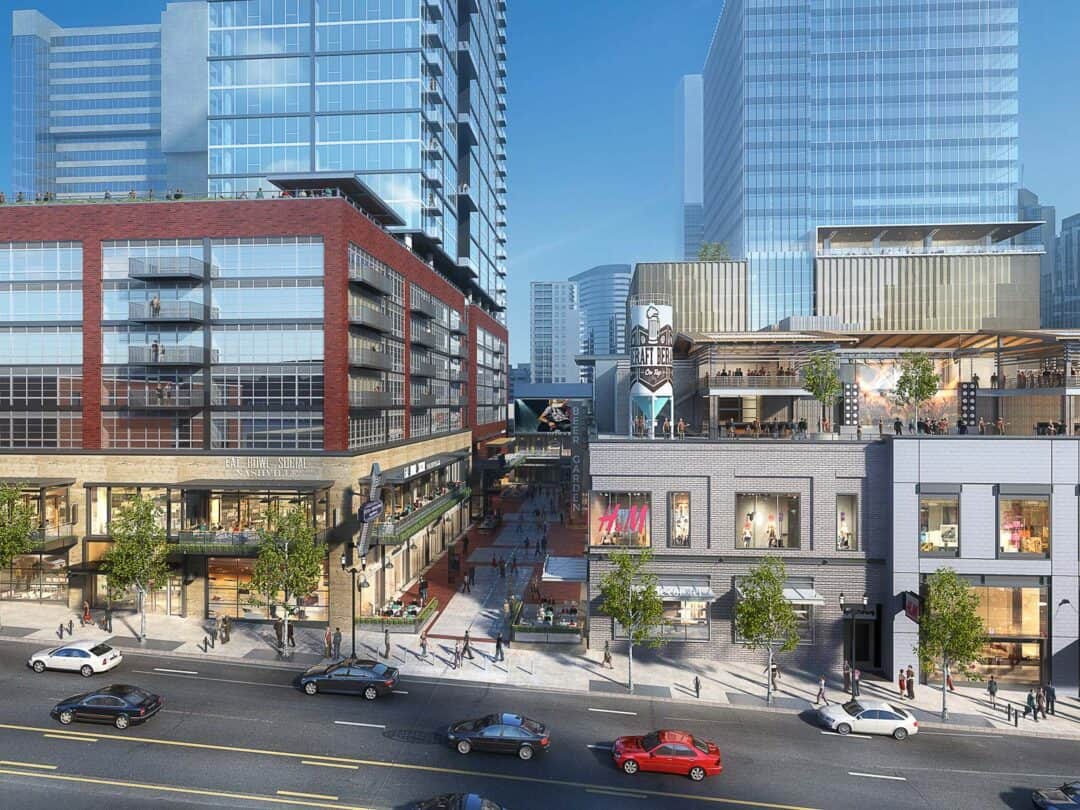

Urban village REITs have reimagined how people interact with urban spaces. Traditional zoning once separated residences from office buildings, retail centers, and entertainment hubs, often resulting in long commutes and disconnected communities. In contrast, the mixed-use urban village model brings these elements together, creating environments where individuals can live, work, and play within a short walk or bike ride.

Properties in these portfolios typically blend residential units, modern office spaces, boutique shops, restaurants, cultural venues, parks, and fitness centers. This thoughtful integration aims to cultivate vibrancy throughout all hours of the day and encourages organic social engagement among residents and visitors. Importantly, these developments serve a wide demographic—from young professionals seeking dynamic neighborhoods to families craving safe, amenity-rich environments to retirees drawn to convenience and community.

The Financial Case for Mixed-Use Urban Village REITs

Investors are steadily gravitating toward mixed-use urban village REITs because of their multifaceted income streams and relative market resilience. Unlike single-use properties—which may be vulnerable to market or sector-specific downturns—mixed-use villages harness multiple drivers of demand. Residential leases, office rents, retail sales, and entertainment revenues together form a diversified and balanced portfolio. When one sector faces headwinds, gains from another can offset potential setbacks, offering a buffer against economic fluctuations.

Furthermore, these mixed-use communities often sustain higher occupancy rates. The presence of round-the-clock activity and on-site conveniences makes them attractive to residents and tenants alike. In densely populated neighborhoods, premium rents and luxury price points are common. For retail and restaurant tenants, the guaranteed foot traffic from residents and nearby office workers can be a game changer, translating to strong and consistent sales.

Designing for Tomorrow

Leading REITs in this space emphasize meticulous master planning. Site designs integrate green spaces, pedestrian walkways, bicycle paths, and public plazas to foster a sense of openness and connection. Rather than the imposing, monolithic architecture characteristic of some city high-rises, these developments prioritize human scale with tree-lined avenues, street-level shops, outdoor dining, and inviting communal areas.

Architectural flexibility further enables these spaces to adapt to changing tenant needs and community trends. For example, office floor plans can be reconfigured for co-working ventures or wellness clinics, while retail spaces might rotate between pop-up boutiques and established brands. This commitment to fluidity is one of the primary reasons these urban villages continue to thrive, regardless of shifts in consumer tastes or work patterns.

Mixed-use developments also often incorporate smart technologies and sustainability measures, responding to growing consumer demand for green and connected living. Energy-efficient materials, water-saving features, solar panels, and sophisticated waste management systems are frequently standard. Smart access controls, fiber-optic internet, and digital concierge services cater to the tech-savvy preferences of contemporary tenants.

Success Stories

Across North America, Europe, and Asia, a handful of REITs have become synonymous with the success of the live-work-play model. In the United States, Federal Realty Investment Trust stands out for its flagship projects like Pike & Rose in North Bethesda, Maryland, and Assembly Row in Somerville, Massachusetts. Both developments exemplify the ethos of the mixed-use village, uniting luxury apartments, AAA office towers, acclaimed restaurants, entertainment venues, parks, and event spaces in walkable, transit-connected neighborhoods.

Similarly, in Canada, RioCan Real Estate Investment Trust spearheads several integrated communities, such as The Well in Toronto. This ambitious downtown development spans multiple city blocks and includes residences, offices, retail markets, and public squares—each element complementing the others to create a bustling urban hub.

Internationally, several Asian REITs have found enormous success in cities like Singapore and Hong Kong, where limited land availability and high population density necessitate intelligent urban planning. CapitaLand Integrated Commercial Trust, for instance, merges retail, commercial, and serviced apartments into cohesive environments, often situated above major transit nodes for unmatched convenience and connectivity.

Community Benefits

The advantages of mixed-use urban villages extend well beyond financial performance. Residents enjoy reduced dependence on automobiles, as daily needs are within walking or biking distance. This lifestyle fosters stronger neighborhood connections, as frequent face-to-face interactions take place in shared spaces. Safety improves as streets remain active beyond the traditional 9-to-5 workday, deterring crime and supporting local businesses.

Mixed-use villages also promote healthier lifestyles. Easy access to fitness centers, farmers’ markets, recreational trails, and green spaces encourages daily exercise and nutritious living. Parents find comfort in safe, child-friendly routes to schools and playgrounds, while seniors appreciate the convenience of nearby healthcare services and social outlets.

These developments can also act as catalysts for urban revitalization. Revamping underused or blighted areas with vibrant, integrated communities enhances property values and tax revenues, breathing new life into city districts that may have languished under single-use zoning.

Adapting to an Evolving Urban Landscape

The pandemic underscored both the strengths and the adaptability of the mixed-use urban village model. As remote work took root and travel patterns shifted, demand for apartments with home office space and high-speed internet rose sharply. Many REITs in this sector swiftly responded by partnering with broadband providers and reimagining amenity spaces for flexible use—from remote work lounges and outdoor terraces to rooftop fitness studios.

Office spaces within mixed-use portfolios also proved more resilient compared to traditional central business district towers. Proximity to residential tenants and retail amenities made them attractive for businesses adopting hybrid work schedules, as employees gravitated toward locations catering to their lifestyle needs and wellness priorities.

Retail and hospitality tenants faced unprecedented challenges across the broader market, yet mixed-use developments often fared better. Built-in customer bases enabled restaurants, cafes, and boutiques to weather the storm, pivoting to takeout and delivery models and capitalizing on loyal, local patronage.

Challenges and Considerations for Investors

While the rewards are formidable, mixed-use urban village REITs are not without complexities. Executing and managing these large, multifaceted projects demands significant expertise, capital, and long-term vision. Master leases must accommodate diverse tenant requirements, while careful curation of retail, dining, and entertainment tenants is essential to maintain vibrancy.

Zoning approvals and municipal partnerships play a crucial role, particularly in regions where traditional land use policies have not fully caught up with the appetite for integrated development. Environmental remediation, infrastructure improvements, and neighborhood engagement remain necessary but demanding components of successful project delivery.

Investors must also consider macroeconomic trends. Shifting population patterns, interest rate environments, and changing consumer preferences all influence returns over time. Yet, the inherent adaptability of urban village models provides reassurance. The mixed-use format’s flexibility—whether updating tenant mixes, integrating new amenities, or embracing technological shifts—stands as one of its greatest strengths.

The Future Outlook

Looking forward, the live-work-play philosophy embodied by mixed-use urban village REITs is set to become an even more integral part of urban real estate. As cities worldwide grapple with affordability, density, sustainability, and livability, thoughtfully planned mixed-use communities offer solutions that balance economic growth with quality of life.

More REITs are expanding their portfolios to include suburban infill projects, leveraging the same principles in emerging markets where demand for walkable, amenity-rich neighborhoods is accelerating. Technological advancements—such as smart building management, digital tenant experience apps, and green construction—will further enhance how these environments function and appeal to new generations of residents and tenants.

Frequently Asked Questions and Answers

1. What is a mixed-use urban village REIT?

A mixed-use urban village REIT is a real estate investment trust that owns, operates, or develops properties combining residential, office, retail, and entertainment spaces. These properties foster integrated “live-work-play” communities where people can easily access daily needs within a walkable environment.

2. How do mixed-use urban village REITs generate income?

These REITs earn revenue from multiple streams, including apartment rents, office leases, retail tenant leases, entertainment venue rentals, and parking fees. This diversified approach reduces investment risk and creates more stable cash flows across market cycles.

3. Why are mixed-use developments considered resilient investments?

The diversified income from various property types—residential, commercial, and retail—means that if one sector experiences a downturn, income from the remaining sectors can offset losses, making these REITs more resilient during economic shifts.

4. Who typically invests in mixed-use urban village REITs?

These REITs attract a wide range of investors, from individuals seeking dependable dividends to institutional investors looking for long-term, stable growth in urban real estate sectors.

5. Are mixed-use urban villages beneficial to communities?

Yes. Mixed-use villages enhance walkability, safety, sustainability, and local economic growth by combining homes, workplaces, green spaces, and recreation in one cohesive community.

6. How do these REITs adapt to changing market trends?

Mixed-use urban village REITs adapt by adjusting tenant mixes, adding new amenities, integrating smart technologies, and responding to evolving work and lifestyle patterns, such as the demand for remote workspaces or eco-friendly features.

7. What challenges do mixed-use urban village REITs face?

Major challenges include navigating complex zoning regulations, coordinating with local governments, managing a wide range of tenants, and ensuring long-term maintenance of diverse facilities.

8. What are some success stories in this sector?

Notable examples include Pike & Rose and Assembly Row in the U.S., The Well in Toronto, and CapitaLand Integrated Commercial Trust in Asia—all celebrated for vibrant communities and strong financial performance.