The Evolving Landscape of Real Estate Investing

In today’s rapidly changing financial climate, real estate remains one of the most reliable avenues for building wealth. Investors are constantly searching for ways to enhance their portfolio management strategies, seeking tools that can streamline processes, deliver accurate data, and empower smarter decisions. The Multiple Listing Service, commonly known as MLS, has long existed at the center of residential and commercial real estate transactions. Traditionally seen as a resource for agents and brokers, MLS technology is now emerging as an indispensable asset for investment portfolio management, offering investors new possibilities for diversification, analysis, and growth.

The MLS Defined

To understand the unique value MLS offers to portfolio management, one must first appreciate what this system represents. Far more than a simple property database, the MLS operates as a sophisticated, collaborative ecosystem. It brings together real estate professionals, ensuring the seamless exchange of property information across local, regional, and even national markets. Each listing within the service is thoroughly vetted, containing detailed data that spans pricing history, property features, ownership records, and transactional timelines. This vetted, highly structured information provides a level of trust and reliability not easily matched by other online platforms.

![]()

Streamlining Acquisition and Disposition Decisions

Investment portfolio management hinges on accurate, timely information to support buy, hold, and sell decisions. MLS systems offer a real-time snapshot of market dynamics. Through comprehensive listings, investors gain insight into current inventory, emerging trends, and comparables in their area of interest. By leveraging this continuous flow of information, they can identify undervalued properties, spot areas with appreciating values, or pinpoint assets likely to align with their investment criteria.

For instance, a commercial real estate investor seeking multi-family buildings can use MLS analytics to review recent sales in comparable neighborhoods, evaluate property age, and examine turnover rates, supplying the foundation for sound financial modeling. Moreover, MLS-based data helps investors quickly adapt to market shifts, allowing for strategic repositioning of assets or timely divestment in response to changing economic conditions. In a landscape where timing often makes all the difference, this visibility can be a game-changer.

Risk Mitigation and Due Diligence

Thorough due diligence sits at the core of every prudent investment strategy. The MLS enhances risk mitigation by providing clarity and granularity rarely found in public listing services. Investors can verify ownership histories, discover any liens or encumbrances, and view previous price adjustments or failed transactions. These records offer critical clues into a property’s history, helping to avoid pitfalls such as unresolved legal disputes or problematic title transfers.

Furthermore, MLS data often includes disclosures about property condition, zoning ordinances, and even pending development plans for surrounding neighborhoods. An investor who conducts thorough due diligence through the MLS places themselves in a much stronger position to anticipate challenges and minimize exposure to hidden liabilities. This heightened transparency not only safeguards capital but also builds confidence in the long-term stability of the portfolio.

Portfolio Diversification Through MLS Insights

Diversification has long been the hallmark of successful portfolio management. By spreading investments across various market segments and geographic locations, investors buffer themselves against localized downturns and erratic shifts in demand. The MLS provides an unparalleled resource for uncovering properties in alternative asset classes, whether that be single-family homes, duplexes, commercial units, or undeveloped land.

Examining MLS records allows investors to identify underserved markets, track migration patterns, and analyze supply-demand imbalances. Insights gleaned from these data points may reveal neighborhoods poised for revitalization or signals of an overheated sector that may warrant caution. With access to such a robust repository, it becomes possible to construct a truly diversified portfolio that can weather both economic cycles and industry-specific disruptions.

Data-Driven Performance Analysis

A well-managed real estate portfolio is not a static compilation of holdings; it is a dynamic, evolving collection that demands ongoing assessment. MLS systems empower investors to monitor portfolio performance using up-to-date market data. By comparing the appreciation rates of owned assets to comparable recent sales, investors can assess whether their investments are keeping pace with broader market trends.

Additionally, MLS resources facilitate property benchmarking. Investors can analyze how individual properties are performing against similar types in the same neighborhood or region. Are rental yields competitive? Is vacancy creeping upwards compared to historical averages? Does the rate of capital gains reflect shifts in the local economy? These insights drive informed decisions regarding retention, renovation, or disposition of assets, ensuring that every element of the portfolio contributes optimally to financial goals.

Enhanced Negotiation Power

Negotiation is an integral part of both acquiring and selling real estate investments. With MLS data at their fingertips, investors approach negotiations from a position of strength. Deep dives into comparable sales data, days-on-market statistics, and price adjustment histories grant investors leverage during discussions with sellers and buyers alike.

Armed with concise, evidential support, an investor might justify a reduced offer by drawing attention to similar listings with longer market exposure or recent drops in asking prices. Conversely, when selling, demonstrated trends of rising values or competitive bidding activity can be employed to maximize returns. This access to curated, credible information levels the playing field, allowing even less experienced investors to negotiate with confidence.

Leveraging MLS for Real Estate Portfolio Expansion

The scalability of a real estate investment portfolio is largely determined by access to reliable opportunities and actionable intelligence. MLS platforms facilitate networking and relationship building with experienced agents who have first-hand knowledge of local markets. These collaborative relationships often lead to early notification of off-market listings, exclusive deals, and insights into neighborhood dynamics that are difficult to uncover via public channels.

For investors keen on expanding across state or even national borders, MLS systems that share data between regions are invaluable. They compress research timelines and reduce the legwork associated with verifying property legitimacy. By leaning on MLS-sourced knowledge and realtor partnerships, portfolio managers can confidently enter new markets, estimate potential returns, and mitigate risks inherent in unfamiliar territories.

Technological Innovations and the Future of MLS in Portfolio Management

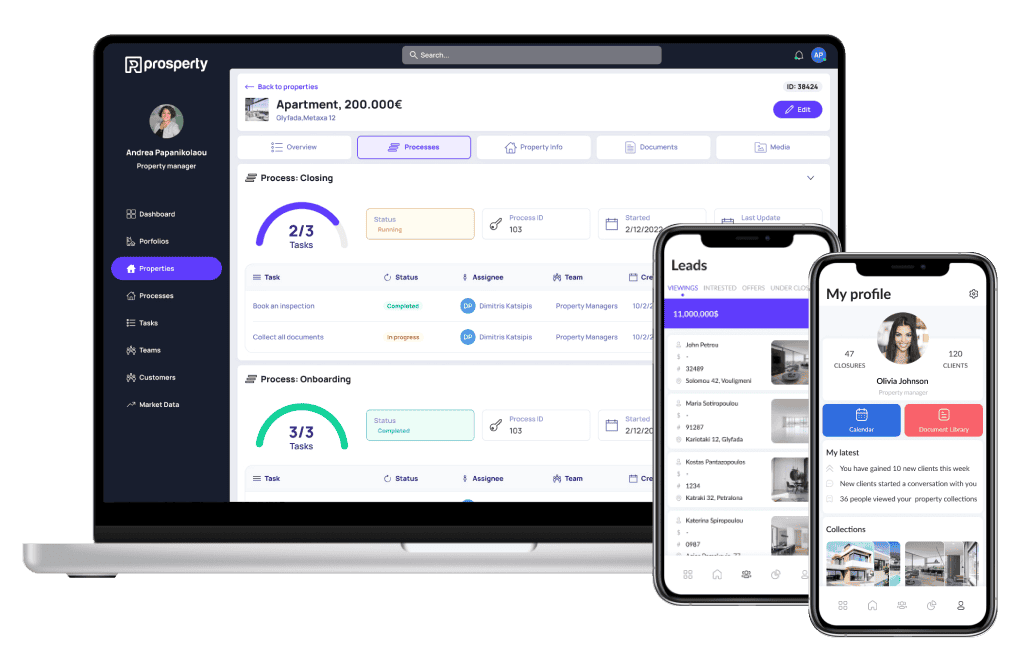

The real estate industry is undergoing a digital transformation, and MLS systems are at the forefront of this shift. Modern platforms integrate with analytical tools, AI-powered valuation models, and cloud-based dashboards, allowing investors to personalize search filters, receive automated alerts, and access detailed comparative reports from anywhere in the world. These technological enhancements reduce the burden of manual research and make portfolio management more efficient than ever before.

As regulatory environments become increasingly supportive of e-signatures and digital documentation, MLS systems are evolving to support seamless end-to-end transactions. Portfolio managers benefit from instant access to essential records, simplified compliance tracking, and expedited closing processes. In the coming years, further integration with blockchain and other digital ledger technologies promises yet another leap in accuracy, security, and transparency, further solidifying MLS as a keystone in the investor’s toolkit.

Frequently Asked Questions and Answers

- How does the MLS assist real estate investors in managing their portfolios? The MLS provides real-time access to verified property data, market trends, and comparable sales. This information helps investors make strategic decisions on buying, holding, or selling assets within their portfolios.

- Can the MLS help with risk assessment for property investments? Yes. Investors can use MLS data to review ownership history, check for liens, and analyze neighborhood trends. This transparency supports better due diligence and lowers the risk of poor investment choices.

- Is MLS data useful for diversifying a real estate portfolio? Absolutely. MLS listings cover various property types and locations, enabling investors to identify new markets or asset classes and diversify for greater portfolio stability.

- How can investors leverage MLS for performance analysis? MLS systems allow owners to benchmark their properties’ value appreciation and rental performance against recent comparable sales, supporting insightful performance reviews and adjustments.

- Does using MLS enhance negotiation when buying or selling investment properties? Yes, MLS provides concrete data on pricing, days on market, and recent trends, empowering investors with facts that strengthen their negotiating positions.

- Can MLS assist with real estate portfolio expansion across different regions? Definitely. Many MLS networks are interlinked nationally or regionally, making it easier for investors to research and purchase properties outside their local market.

- Are there technological tools within MLS platforms that improve portfolio management? Modern MLS systems incorporate advanced search filters, analytics, alerts, and integrated reports. These technologies streamline research and make investment management more efficient.

- What future innovations can investors expect from MLS platforms? MLS platforms are advancing toward greater digital integration, including remote transactions, AI-driven analysis, and, eventually, blockchain-enabled verification for enhanced accuracy and transparency.