Many property owners are tempted by the idea of managing their rental properties themselves, often with the goal of saving money on management fees. After all, property management companies charge a percentage of your monthly rental income-usually between 8-12%-and this can feel like an unnecessary expense. But the truth is, do-it-yourself property management might actually cost you more than you think, in both time and money.

While managing your own rental property seems pretty straightforward, it encompasses so many tasks that are quite complex and time-consuming than they may superficially appear. From tenant screening and lease agreements to maintenance and legal compliance, there’s quite a lot at stake here. In this article, we will look at the hidden costs of DIY property management and discuss why hiring a professional property manager might actually save you more in the long run.

1. The Hidden Costs of Time and Energy

One of the major disadvantages of managing properties by oneself is the time and energy it involves. Managing tenants, maintenance issues, collection of rent, and complaints can all add up rather quickly, especially if you have more than one property. The time used up in managing your property is time that could be used at your job, business, or personal life. The cost in terms of time is, in fact, one of the major concerns for most landlords.

How Time Can Cost You:

– Tenant Screening and Selection: Finding reliable tenants involves advertising, reviewing applications, conducting interviews, and running background checks. This process is time-consuming, and if done poorly, it could lead to problematic tenants who cause long-term headaches.

Maintenance Requests and Repairs: It includes responding to maintenance issues, coordinating repairs, and handling emergencies like a broken pipe or malfunctioning HVAC system. This can be very time-consuming, often during nights or weekends, and can easily become a source of constant stress if managed yourself.

– Tenant Communications: Returning calls, texts, and emails regarding any matter at hand, from minor irritations through serious problems, will absorb an inordinate amount of time. Besides that, being a referee over complaints involving neighbors, parking, and/or rent increases may often involve more work than you really imagine.

Why They Will Love It:

Tenants want their requests for maintenance to be responded to quickly and to be communicated with effectively. If you have a multitude of responsibilities, you may not have the time to respond promptly, and your tenants may become dissatisfied and frustrated. This can affect tenant retention and lead to higher turnover rates, costing you more money in the long run.

How a Property Manager Can Help:

Property managers have systems in place to streamline all aspects of property management. From efficient tenant screening to 24/7 maintenance support, they can handle the day-to-day tasks, freeing up your time for other priorities.

2. Costly Mistakes Due to Inexperience

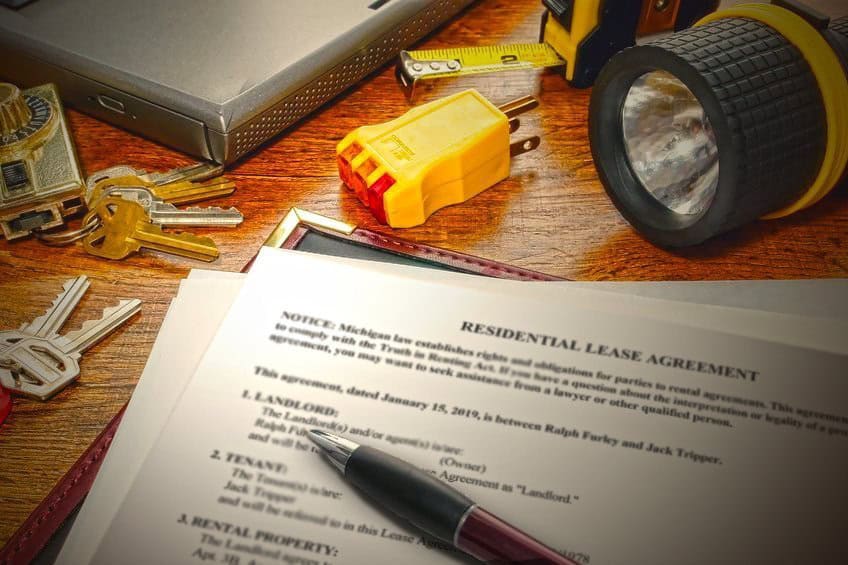

Even with a good level of knowledge regarding real estate, there is a huge chance of error when managing your own property. Property management consists of many minute legal and regulatory requirements, which often get overlooked in case one lacks experience in this field. From handling lease agreements and security deposits right to compliance with fair housing laws, there are plenty of ways costly errors can cost a person both money and time.

Common Mistakes DIY Landlords Make:

– Wrongful Evictions: You may be taken to court if you evict a tenant incorrectly. Without the proper understanding of the eviction laws in your state or municipality, you may unknowingly violate one of them, and it could cost you hundreds or thousands of dollars in fines, penalties, and legal fees.

– Unclear Lease Agreements: A poorly drafted lease agreement may leave you open to legal disputes down the line. For example, if the lease doesn’t specify policies regarding late payments, pet ownership, or property maintenance, tenants might take advantage of the lack of clarity, leading to tension and potential losses.

– Fair Housing Violations: Fair housing laws protect tenants against discrimination based on race, religion, sex, disability, and other protected categories. If you are not familiar with these laws, you can easily commit a violation in selecting tenants and you could be taken to court, which will cost a lot and hurt your reputation.

– Improper Security Deposit Handling: Security deposits must be managed according to state laws, which vary from place to place. If you don’t follow these rules, you could face legal action or be forced to refund the deposit.

How a Property Manager Can Help:

Professional property managers have experience in legal matters and know how to work within the framework of local, state, and federal regulations. They will make your leases tight, handle evictions correctly, and protect you from falling into any legal pitfalls. Their experience reduces the risk of expensive legal mistakes.

3. Neglecting Marketing and Tenant Retention

One of the most critical areas of property management involves keeping your property rented. If your property sits empty for a period of time, this could amount to some hefty losses. Managing properties on your own may cause you to overlook vital strategies that will enhance marketing and tenant retention, leading to longer vacancies or increased turnover rates.

#### How DIY Management Can Cost You:

– Poor Marketing: If you have no idea about how to market your property, chances are that you may not get better tenants. Property management firms have an established marketing way in which they list your property on several platforms, photograph high-quality photos, and write compelling ads that appeal to the best audience.

– Poor Tenant Screening: In your hurry to fill vacancies, you may accept tenants who are not the best fit for your property. Poor tenant selection may result in late rent payments, property damage, or complaints from neighbors.

– High Turnover: Without a focus on tenant retention, tenants may leave after a short stay, resulting in increased vacancy rates and additional costs for advertising and tenant screening. High turnover is expensive and can eat into your profit margin.

How a Property Manager Can Help:

A property manager can help you find tenants faster and ensure they are the right fit for your property. They know how to market effectively, where to advertise, and how to present your property in the best light. Moreover, they specialize in tenant retention, offering strategies to keep good tenants happy and renew leases year after year.

4. Unexpected Repair and Maintenance Costs

One of the biggest frustrations of DIY property management is dealing with unexpected repair and maintenance costs. Whether it’s a plumbing issue, a broken appliance, or an electrical problem, these situations can arise at any time, and often when you least expect it.

How DIY Management Can Cost You:

– Emergency Repairs: If there is an emergency, like a burst pipe or furnace in winter, you are going to be at the mercy of whoever will do the job in an emergency, which is usually at inflated prices because you don’t have previous relationships with contractors or service providers.

– Inefficient Repairs: A DIY landlord may attempt minor repairs himself, which often means a shoddy workmanship job that may mean more costly repairs later on.

Lack of Preventive Maintenance: Not having a routine maintenance schedule can easily turn minor issues into major problems. Regular maintenance prevents costly repairs and keeps your property in good condition.

How a Property Manager Can Help:

Property management companies have a network of trusted contractors and vendors, allowing them to negotiate better rates for repairs and maintenance. They also perform regular inspections to identify potential issues before they become major problems, saving you money in the long run.

5. Inefficient Rent Collection and Late Payments

Collecting rent is seemingly not a big deal, yet it may soon develop into a headache, especially when tenants are late or never pay at all. If you don’t have the right systems to do so, collecting rent and enforcing late fees can cost you time, money, and stress.

How DIY Management Can Cost You:

– Late Payments: Late or no-time payments by tenants disturb your cash flow. If you are not agile in reminding your tenants for the payment of rent or imposing fines on late payments, you may face delays in receiving rents.

– No System for Tracking Payments: If you don’t have a proper system for tracking rent payments, you might lose track of who has paid and who hasn’t, leading to confusion and missed payments.

– Eviction Costs: If the tenants do not pay rent for a very long time, you may have to go through the process of eviction. This is indeed costly and time-consuming; the whole process of evicting a tenant includes court fees, lawyer fees, and months of unpaid rent.

How a Property Manager Can Help:

A property manager efficiently and professionally collects rent. They track payments, enforce late fees, and, if necessary, file legal action to ensure that your rental income is stable.

Conclusion: The True Cost of DIY Property Management

While managing your property yourself might seem like a cost-saving strategy, the hidden costs—time, energy, legal mistakes, marketing inefficiencies, unexpected repairs, and late rent payments—can add up quickly. The cumulative effect of these costs can outweigh the savings you think you’re making by avoiding property management fees.

By hiring a professional property manager, you free up your time, reduce your stress, and avoid costly mistakes. Property managers handle everything, from tenant screening and legal compliance to maintenance and the collection of rent. By assigning these tasks to professionals, you will guarantee that your investment is properly managed and, as a consequence, increase your rental income while reducing your risks.

So, before you decide to go the DIY route, carefully consider the long-term financial impact. In many cases, hiring a property manager might actually save you money and provide peace of mind—making it a wise investment in your rental business.