Introduction

Real estate investment is often seen as a secure and lucrative way to build wealth. Property ownership provides tangible assets, potential passive income, and a hedge against inflation. However, while the benefits are enticing, real estate investment’s hidden and overt costs can surprise seasoned investors. From initial acquisition expenses to ongoing maintenance and market volatility, the actual costs of investing in property can significantly impact profitability. Understanding these costs is essential for anyone seeking to enter the real estate market or develop their portfolio.

The Real Cost of Investing in Real Estate

Investing in real estate isn’t just about the sticker price of a property. Numerous factors contribute to the actual cost, including upfront expenses, ongoing costs, and risks tied to market conditions. Below are the primary costs you need to consider:

Purchase Price and Down Payment

The most apparent cost of investing in real estate is the purchase price. However, acquiring a property usually requires a significant down payment, from 10% to 25% of the property’s value, depending on the financing terms and location.

For instance, purchasing a $300,000 property with a 20% down payment would require $60,000 upfront. The rest is financed through a mortgage, leading to additional costs like interest payments.

Loan Interest and Mortgage Payments

Real estate investments often involve borrowing, which incurs interest costs. Over the life of a 30-year mortgage, the interest can sometimes exceed the original loan amount. For example, a $240,000 loan at a 5% annual interest rate could result in over $220,000 in interest payments.

Closing Costs

Closing costs include appraisals, inspections, legal services, and title insurance fees. These typically amount to 2%- 5% of the property value, which can significantly impact the initial investment.

Property Taxes

Real estate owners must pay annual property taxes based on the property’s assessed value. Tax rates vary by location, adding thousands of dollars to yearly expenses.

Insurance Premiums

Property insurance protects your investment against fire, theft, or natural disasters. However, additional liability insurance might be necessary for rental properties, adding to the overall cost.

Maintenance and Repairs

Every property requires regular upkeep, such as painting, plumbing, or HVAC maintenance. Older properties may incur higher repair costs, while newer properties often have warranties to mitigate some of these expenses.

Vacancy Costs

For rental properties, vacancies can lead to lost income while fixed expenses like mortgage payments and taxes continue. Preparing for these gaps is crucial for long-term profitability.

Opportunity Costs

Investing in real estate ties up capital that could be used for other investments. Understanding the opportunity cost of your real estate investment is critical for evaluating its true profitability.

Strategies to Minimize Real Estate Investment Costs

Despite the costs associated with real estate investment, there are ways to mitigate them and boost profitability. Here are some effective strategies:

Negotiate Purchase Prices

Strong negotiation skills can help you secure properties below market value, instantly increasing your potential returns. Work with experienced real estate agents and study market trends to identify undervalued properties.

Opt for Favorable Financing

Shop around for the best mortgage rates and terms. A minimal interest rate can save tens of thousands over the loan’s lifetime. Consider paying points upfront to reduce the interest rate or explore government-backed loans if you qualify.

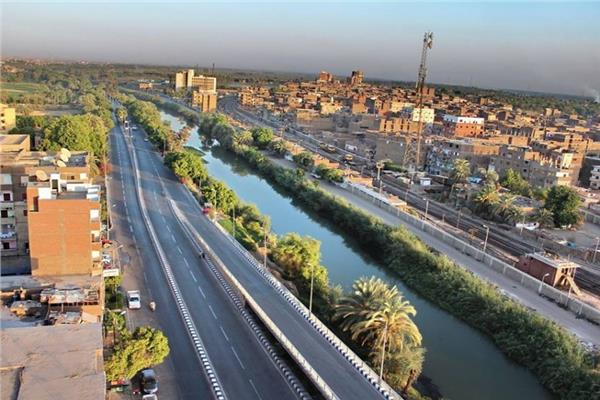

Invest in Growing Markets

Investing in emerging markets with lower property prices and higher growth potential can yield substantial returns. Look for areas with strong job growth, infrastructure development, and population increases.

Leverage Tax Benefits

Real estate investors benefit from tax deductions for mortgage interest, property taxes, depreciation, and certain repairs. Consult a tax professional to develop your deductions and reduce your taxable income.

Perform Due Diligence

Thoroughly research properties before purchasing. Get comprehensive inspections to uncover potential issues that could lead to costly repairs. Assess market trends and property values in the area to ensure long-term profitability.

Manage Properties Efficiently

If you have rental properties, efficient management is critical. Hiring a property manager may reduce vacancies and improve tenant relations, but self-managing can save on management fees if you have the time and expertise.

Maintain an Emergency Fund

Setting aside funds for unexpected expenses, like major repairs or prolonged vacancies, ensures you can weather financial challenges without jeopardizing your investment.

The Role of Market Timing in Real Estate Investment

Market timing is critical in determining the profitability of real estate investments. Buying during a seller’s market when high demand often leads to inflated prices, which can diminish returns. Conversely, entering the market during a buyer’s market, when inventory exceeds demand, allows investors to purchase properties at lower prices, creating a more significant potential for appreciation.

Savvy investors also monitor economic indicators such as interest rates, inflation, and employment trends, influencing property values and rental demand. For instance, low interest rates can reduce borrowing costs, making it easier to finance properties, while strong job growth in a region signals higher demand for housing.

Additionally, seasonal trends can impact market conditions. Historically, spring and summer are active times for real estate transactions, potentially leading to higher competition and prices. Winter months, however, may present opportunities for better deals due to lower activity.

While timing the market ideally is nearly impossible, remaining informed about economic conditions and market trends can help you make smarter investment decisions; rather than trying to “time the bottom,” focus on purchasing properties that align with your long-term financial goals and provide a solid return on investment over time.

Advantages of Understanding Real Estate Costs

Being aware of the actual costs associated with real estate investment offers several advantages:

- Better Financial Planning: Accurate cost estimation ensures you allocate resources effectively.

- Improved Decision-Making: Discovering hidden costs helps you choose properties that align with your financial goals.

- Risk Mitigation: Understanding potential pitfalls allows you to effectively prepare for and manage risks.

- Enhanced Profitability: Identifying cost-saving strategies boosts your overall returns.

Diversifying Your Real Estate Investment Portfolio

Diversification is a cornerstone of successful investment methods, and real estate is no exception. Relying solely on one property type or market can expose investors to significant risks. Diversifying your portfolio across different property kinds, geographic locations, and investment strategies can help mitigate these risks and enhance overall returns.

For example, combining residential properties like single-family homes and multi-family units with commercial properties such as office spaces or retail centers creates a balanced portfolio. While residential properties may offer steady cash flow, commercial properties often yield higher returns but have greater volatility.

Geographic diversification is equally important. Investing in different cities or regions shields your portfolio from localized economic downturns. For instance, if one area experiences a decline in property values due to job losses, investments in other thriving markets can offset the impact.

Real estate investors can diversify through indirect choices, like Real Estate Investment Trusts (REITs), which deliver exposure to various property types and markets without requiring direct ownership. Alternatively, crowdfunding platforms provide investment opportunities in real estate projects with smaller capital commitments. By diversifying your real estate holdings, you create a resilient portfolio capable of weathering market fluctuations while maximizing growth opportunities.

Frequently Asked Questions(FAQs):

Is real estate investment still profitable despite high costs?

Yes, real estate can still be highly profitable if managed wisely. Understanding and minimizing costs, leveraging tax benefits, and investing in growth markets can significantly enhance returns.

How can I estimate maintenance costs for a property?

A general rule is to allocate 1%-3% of the property’s value annually for maintenance. However, the property’s age, location, and condition can influence this amount.

What are the best forms to finance a real estate investment?

The best financing choice depends on your financial situation. Options include conventional mortgages, government-backed loans, private lending, or cash purchases. Comparing interest rates and terms is vital to finding the best fit.

How can I reduce vacancy rates in rental properties?

To minimize vacancies, focus on tenant retention by providing excellent service, maintaining the property well, and offering competitive rental rates. Effectively marketing your property can also attract quality tenants quickly.

Are there any tools to calculate real estate investment costs?

Several online calculators and software tools estimate costs and returns. These tools can factor in purchase price, financing terms, taxes, insurance, and maintenance.

What is the best type of property for first-time investors?

Due to their affordability and high demand, single-family homes are often a good starting point for first-time investors. Multi-family units can also be profitable but may require more management.

Can real estate investment be passive?

Yes, real estate investment can be passive if you hire property managers or invest in real estate investment trusts (REITs). These options allow you to earn income without hands-on involvement.

What are the risks of investing in real estate?

Key risks include market downturns, high vacancy rates, unexpected maintenance costs, and interest rate fluctuations. Conducting thorough research and maintaining a financial buffer can mitigate these risks.