Understanding Credit Scores in Dubai

Definition and Importance of Credit Score

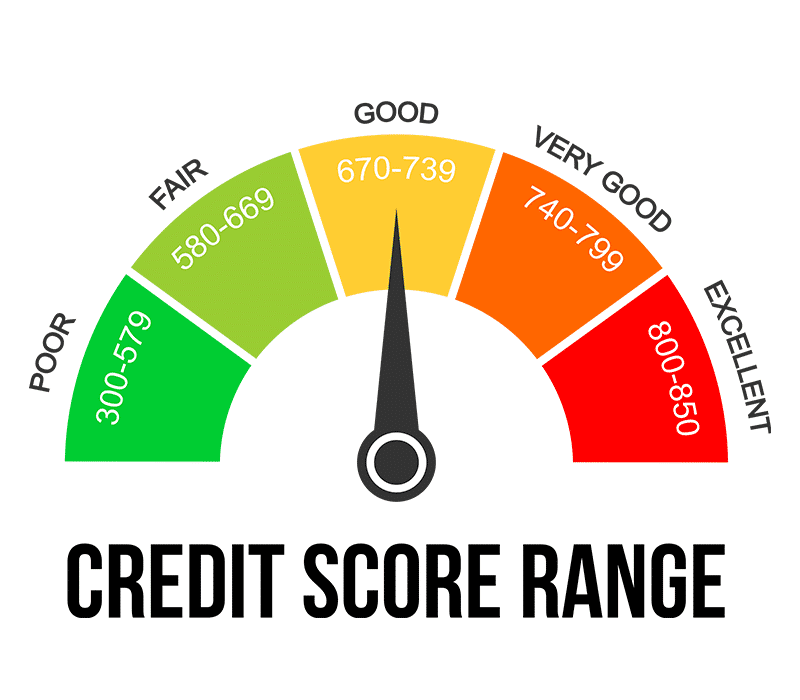

A person’s credit score, a three-digit figure between 300 and 900, indicates their creditworthiness. It measures the risk that a lending institution would take if it lent money to the individual. The risk decreases with increasing credit score and vice versa.

A person’s credit score is a crucial component of their financial history. It reflects their ability to manage finances, make timely payments, and handle debt. A good credit score is necessary for obtaining loans, credit cards, and other financial products. Bad credit can result in increased interest rates, denied credit applications, trouble obtaining housing or a job, and more.

Al Etihad Credit Bureau (AECB) Overview

The Al Etihad Credit Bureau (AECB) is the official credit reporting agency in the UAE, including Dubai. A government entity established in 2014, It gathers and keeps track of credit data on UAE citizens and companies. The AECB provides credit reports and scores to individuals and companies upon request. To obtain a credit report, an individual must register on the AECB website, provide the necessary details, and pay a fee. The credit report contains information about an individual’s credit history, including credit accounts, payment history, and outstanding debts.

The AECB credit score is based on an individual’s credit history and ranges from 300 to 900. A higher score indicates a lower risk, while a lower score indicates a higher risk. Financial institutions in the UAE widely use the AECB score to evaluate an individual’s creditworthiness when considering loan or credit card applications.

In conclusion, understanding credit scores and their importance is crucial for financial stability in Dubai. The AECB provides an efficient and reliable way to obtain credit reports and scores; It can assist people in making wise financial decisions.

Components of a Credit Score

A credit score is a three-digit number determining an individual’s financial prudence and creditworthiness. It is calculated based on various factors that credit bureaus take into consideration. The following are the components of a credit score:

Payment History and Timeliness

Payment history is one of the most critical components of a credit score. It refers to an individual’s ability to pay their bills on time. A credit score can be significantly impacted by missing payments, late payments, or loan default. The effect is more detrimental the longer the delay.

Credit Utilization and Limits

Credit utilization is the amount of credit an individual uses compared to their credit limit. It is computed by dividing the credit limit by the outstanding balances. A high credit utilization ratio may adversely impact a credit score. To maintain a good credit score, it is recommended to keep credit utilization below 30%.

Duration of Credit History and Credit Types

The length of credit history is the duration of an individual’s credit accounts. A more extended credit history can positively impact a credit score. Individuals’ credit types also play a role in determining their credit score. Your credit score can rise if you have a range of credit, such as credit cards, mortgages, and loans.

New Credit and Credit Inquiries

New credit and credit inquiries refer to an individual’s recent credit applications. Applying for multiple credits quickly can negatively impact a credit score. It is recommended that credit applications only be limited to necessary ones.

In conclusion, a credit score is essential to an individual’s financial life. Maintaining a good credit score to access credit facilities and better interest rates is crucial. A credit score’s components must be considered to maintain a good credit score.

Acquiring Your Credit Report

There are several ways to acquire your credit report in Dubai. The following subsections will provide the necessary information to obtain your credit report and understand its data.

AECB App and Online Services

One of the easiest ways to obtain your credit report in Dubai is through the AECB app or online services. Downloads for the AECB app are available in either the App Store or Google Play on cellphones running iOS and Android. To access the app, you must sign in or create an account on the AECB website.

Once you have signed in, you can obtain your credit report with or without a credit score. The prices for both options may vary. After payment, you will receive your credit report at your registered email address within a few minutes.

Required Documents and Steps

You must provide the necessary information to obtain your credit report, such as your Emirates ID and passport number. You can register for the AECB app or online services and provide the necessary information to access your credit report.

Understanding Your Credit Report Data

Various data points in your credit report, providing an extensive overview of your credit history, can help assess your creditworthiness. Your credit score, a three-digit number that predicts the likelihood of you missing payments in the next calendar year, will also be included. The degree of risk decreases with increasing credit scores.

Your credit report will also include information about your credit accounts, such as your payment history, credit limit, and outstanding balance. It will also include information about your credit inquiries and any collections or bankruptcies.

In summary, you can obtain your credit report in Dubai quickly by using the AECB app or online services. To determine your creditworthiness, you’ll need to provide essential information like your Emirates ID and passport number, and your credit report will encompass several data points.

Improving Your Credit Score

It may take some time to raise your credit score, but the effort is worthwhile. The following suggestions will assist you in improving your Dubai credit score:

Consistent and Timely Bill Payments

Making consistent and timely payments is critical to improving your credit score. This includes paying your credit card, phone, and other bills on time. Never miss a payment by setting up automated payments or reminders.

Reducing Outstanding Balances and Managing Debts

Reducing your outstanding balances can also improve your credit score. Keep your credit card debt within 30% of your available credit. This can assist you in avoiding defaults and late payments and demonstrate to lenders that you are in charge of your credit.

Managing your debts is also essential. If you have several debts, you can get a reduced interest rate by combining them into a single loan. This can help you save money on interest and make it easier to manage your debts.

Avoiding Negative Financial Behaviors

Avoiding negative financial behaviors can also help improve your credit score. This includes avoiding bounced cheques, missed payments, and defaults. Consider getting in touch with lenders to go over your choices if you find it difficult to make payments. They can offer you a payment plan or other assistance.

Although it takes time and work, you can raise your credit score. By making consistent and timely payments, reducing your outstanding balances, and avoiding negative financial behaviors, You can improve your chances of being approved for credit cards and loans in Dubai by raising your credit score.

Impact of Credit Scores on Financial Products

A credit score is crucial in determining an individual’s eligibility for various financial products, including loans, mortgages, credit cards, and insurance policies. Financial institutions, lenders, and finance companies use credit scores to assess an individual’s creditworthiness and determine the risk involved in lending money.

Loans and Mortgages

Having a high credit score is necessary when requesting a loan or mortgage. A higher credit score usually correlates with better terms and lower loan rates, indicating decreased risk. Conversely, a lower credit score can lead to harsher conditions, higher interest rates, or even rejection of the application.

Credit Cards and Credit Limits

Credit cards are another financial product that is impacted by credit scores. A good credit score can help an individual secure a higher credit limit, lower interest rates, and better rewards. In contrast, a poor credit score may lead to a lower credit limit, higher interest rates, and fewer rewards or benefits.

Insurance and Interest Rates

Credit scores can also impact insurance policies. Insurance firms can use credit scores to calculate premium costs for different types of policies. Lower premium rates can arise from a higher credit score, while higher premium rates could come from a lower credit score.

To be eligible for advantageous conditions on financial products and credit facilities, one must have a high credit score. Higher borrowing rates, unfavorable terms, and application rejection can result from a low credit score. Therefore, Maintaining a low credit card balance, paying payments on time, and avoiding pointless credit queries are all critical to maintaining a solid credit score.

Dealing with Credit Score Issues

Identifying and Disputing Errors

Inaccuracies in credit reports are not uncommon, and they can significantly impact an individual’s credit score. Therefore, it is essential to check credit reports for errors and inaccuracies regularly. Individuals can dispute an error with the relevant authorities if it is identified.

To dispute an error in a credit report, individuals must first obtain a copy of their credit report from the authorized signatory. If they find an error, they can write a letter to the UAE government detailing the mistake and providing evidence to support their claim. Ensuring that the letter is signed and dated is essential.

Consequences of Low Scores and Defaults

Low credit scores and defaults can have severe consequences for individuals. They can make obtaining loans, credit cards, and other financial products challenging. Additionally, defaults can result in legal action being taken against individuals.

To avoid the consequences of low scores and defaults, individuals must make all payments on time and in full. They should also prevent overborrowing and taking on more debt than they can repay.

Legal Aspects and Rights of Individuals

Individuals have legal rights regarding credit scores and reports. The UAE government has implemented regulations to protect individuals from unfair practices by lenders and credit bureaus.

People can report suspected violations of their rights to the appropriate authorities. It is imperative to have comprehensive documentation of all correspondence and transactions pertaining to credit reports and ratings.

In summary, dealing with credit score issues requires individuals to check their credit reports for errors and inaccuracies regularly. If you find an error, you can dispute it with the relevant authorities. Additionally, individuals must make all payments on time and in full to avoid the consequences of low scores and defaults. Finally, individuals have legal rights regarding credit scores and reports, and they should take steps to protect those rights if necessary.

Maintaining a Good Credit Score

Sustaining a favorable credit score is crucial to obtaining improved loan terms and approval in Dubai. It can also help reduce credit risk and increase the likelihood of approval for a credit card, personal loan, or mortgage. Here are some ways to maintain a good credit score.

Responsible Credit Management

Responsible credit management involves making timely repayments, avoiding late payments, and keeping credit utilization low. Credit utilization is the amount used compared to the total credit limit. As long as credit use stays below 30% of the entire credit limit, one can keep a high credit score.

Regular Monitoring and Review

Regular monitoring and review of credit information is essential to maintain a good credit score. By checking credit reports regularly, individuals can identify any errors or inaccuracies and take corrective action. The Al Etihad Credit Bureau provides a credit score ranging from 300 to 900, with a score of 750 and above considered excellent.

Strategic Financial Planning

Strategic financial planning is necessary to maintain a good credit score. It involves creating a budget, tracking expenses, and setting financial goals. Individuals can also consider consolidating accounts and debts to reduce the number of accounts and make repayments more manageable.

In conclusion, prudent credit management, consistent monitoring and evaluation of credit data, and calculated financial planning are all necessary to preserve a high credit score in Dubai. By following these steps, individuals can increase their chances of getting credit approval and securing better loan conditions.

Frequently Asked Questions

What is considered a good credit score in Dubai?

A good credit score in Dubai ranges from 300 to 900, with 900 being the highest. In Dubai, a credit score of 700 or more is typically regarded as good. A person’s creditworthiness increases with a higher credit score, improving the chances of loan or credit card approval.

In the UAE, how can I check my credit score for free online?

Unfortunately, there are no free options for checking your credit score online in the UAE. However, you can obtain your credit score and report for a fee through the Al Etihad Credit Bureau (AECB) website or by visiting one of their offices.

What is the UAE minimum credit score needed to get a loan?

Depending on the lender and type of loan, different minimum credit scores are needed in the UAE. But most lenders would rather see a credit score of at least 700. Remember that having a higher credit score increases your chances of loan approval and could lead to securing better interest rates.

How is a credit score determined in Dubai?

A number of variables, such as credit use, length of credit history, credit kinds used, payment history, and recent credit inquiries, affect a credit score. Payment history and credit utilization are the most significant factors that affect a credit score. A credit score might rise with a track record of on-time payments and modest credit utilization. While late and high credit utilization can decrease it.

Can I improve my credit score, and if so, how?

In Dubai, it is feasible to raise your credit score. Paying bills on time, keeping a low credit utilization ratio, avoiding creating too many new credit accounts, and routinely reviewing credit reports for inaccuracies are some strategies to raise a credit score.

What is the highest credit score achievable in Dubai?

The highest credit score achievable in Dubai is 900. However, it is essential to note that achieving a perfect score is rare and optional to obtain credit. Lenders typically consider a credit score of 700 or above reasonable, which can lead to favorable interest rates and loan approvals.

DUBAI MLS.

Dubai MLS serves as the ultimate platform for real estate professionals. It allows them to delve into emerging brokerages, establish vital connections with potential clients, and expand their professional network. Offering a wide range of opportunities, Dubai MLS presents a comprehensive ecosystem. Explore its diverse array of services and pave your way to success.