Real estate investment has long been a secure path to building wealth and financial freedom. In particular, rental properties offer a unique opportunity to generate consistent income while benefiting from long-term asset appreciation. For many Arab investors seeking to diversify their income sources or prepare for the future, building a rental property portfolio is a smart and sustainable strategy.

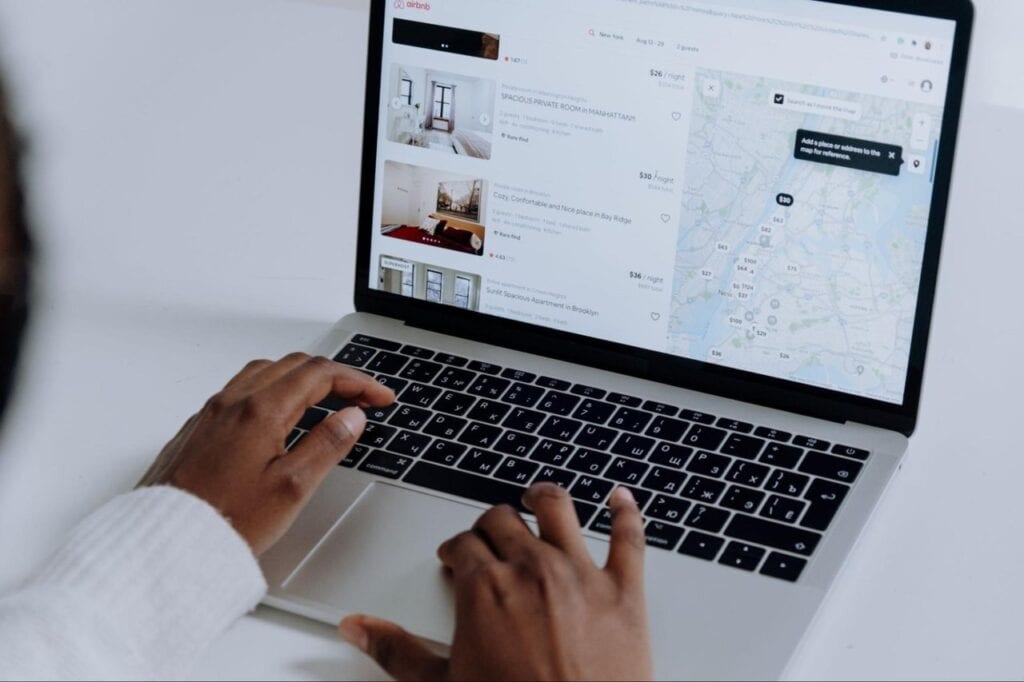

But where should you start? One of the most powerful tools in the hands of any real estate investor is the Multiple Listing Service (MLS) — a centralized platform used by real estate professionals to list and find properties. By understanding how to use MLS data effectively, you can identify valuable investment opportunities, make informed decisions, and build a solid rental property portfolio over time.

This article guides you through the process, from planning your strategy to using MLS listings to find, analyze, and manage your rental properties.

What Is a Rental Property Portfolio?

A rental property portfolio is simply a collection of real estate assets that you own and rent out to generate income. Instead of putting your savings into just one property, you spread your investment across several — which helps reduce risk and creates multiple income streams.

Some investors choose to focus on one type of property, like single-family homes. Others prefer variety — such as owning both apartments and villas in different cities. As your portfolio grows, you gain more control over your financial future. You can sell or refinance properties, increase rental income, or use your assets as collateral for further investments.

However, building a portfolio isn’t just about owning more properties. It’s about choosing the right properties, in the right locations, and managing them well. This is where MLS listings come in.

Understanding MLS and Why It Matters

MLS, short for Multiple Listing Service, is a private database used by licensed real estate professionals to list properties for sale or rent. It includes detailed property information such as location, size, features, photos, pricing history, and much more. For investors, MLS is more than just a listing site — it’s a powerful research and planning tool.

Using MLS, you can search for properties that fit your investment goals. You can see what’s currently available, what recently sold, and what price trends are emerging. You can compare neighborhoods, track average rental prices, and understand which areas are growing in demand.

For Arab investors looking to enter new markets or expand within familiar ones, MLS provides an organized and data-driven way to make smart decisions. It also allows you to act quickly when a promising property becomes available.

Step One: Set Clear Investment Goals

Before you begin browsing MLS listings, it’s important to define your investment goals. This will help you narrow your search and avoid distractions. Some investors want a high monthly income. Others focus on long-term appreciation. Some prefer low-maintenance properties, while others are open to renovation projects.

You should consider how much capital you’re willing to invest, whether you want to self-manage or hire a property manager, and whether your focus will be local or international. For example, if your goal is to build a portfolio in fast-growing university cities, you may want properties near campuses that attract students year-round. If your priority is family tenants, you may look for suburban homes with gardens and schools nearby.

Having a clear vision helps you use the MLS more effectively by filtering out properties that don’t align with your strategy.

Step Two: Research Neighborhoods Using MLS

Location is everything in real estate. Even the best property can underperform if it’s in the wrong neighborhood. Fortunately, MLS allows you to research neighborhoods in detail. You can look at property prices over time, see how quickly homes are rented or sold, and compare average rental rates in different areas.

For example, if you notice that a particular neighborhood has rising prices and a low vacancy rate, it may signal a growing demand. On the other hand, areas with high turnover or price reductions could indicate underlying problems. You can also assess whether local developments, infrastructure projects, or population growth are likely to affect the market in the near future.

Some neighborhoods are better suited for short-term rentals, while others perform well with long-term leases. MLS data helps you spot those patterns and decide where your investment will perform best.

Step Three: Search for Properties That Match Your Criteria

Once you’ve identified promising neighborhoods, you can use MLS to search for available properties that align with your investment criteria. You can filter results by location, price, size, number of bedrooms and bathrooms, and other features.

At this stage, pay attention to the details provided in the listing. Look for properties that are in good condition, priced competitively, and located near important services like public transportation, schools, hospitals, or shopping centers. Photos, floor plans, and property descriptions can help you assess whether the home is ready for tenants or if it needs renovation.

Also, consider the potential rental income. Some MLS listings include information about current or past rent, which gives you a sense of what to expect. If this data is missing, look at similar properties in the area and calculate an estimate.

Don’t be discouraged if the perfect property doesn’t show up immediately. Successful investors know that patience and persistence are key.

Step Four: Analyze Rental Potential

After identifying a few potential properties, it’s time to analyze their rental potential. This means estimating how much income they can generate and comparing it to the costs of ownership. These costs may include mortgage payments, property taxes, insurance, maintenance, and management fees.

Use MLS data to estimate realistic rental income. Look at similar properties nearby that are currently rented. Are they fully occupied? How long do they stay on the market before being rented? This gives you an idea of demand and rent stability.

Once you have the income estimate, subtract your expenses to determine your net cash flow. Ideally, you want positive cash flow — meaning the rent covers your costs and leaves a profit.

Even if a property offers lower cash flow in the short term, it might still be valuable if it’s in an area with strong appreciation potential. The goal is to balance income and long-term growth across your portfolio.

Step Five: Secure Financing and Make the Purchase

Once you’ve found a promising rental property through MLS, the next step is financing. Depending on your financial situation and location, you might use personal savings, a mortgage, or partnerships. Arab investors often explore Sharia-compliant financing options or co-invest with family members.

Before making an offer, work with a trusted real estate agent or advisor to ensure the property is priced fairly. MLS listings usually include data on similar nearby sales (known as “comparables”) that help you evaluate the asking price.

Once the deal is finalized, begin preparing the property for rental — whether that involves minor repairs, furnishing, or marketing the unit.

Step Six: Grow and Diversify Your Portfolio

After acquiring your first rental property, the journey has just begun. Your goal should be to continue building your portfolio steadily, one property at a time. Each new investment should complement the others and reduce your overall risk.

You might choose to diversify by buying in different cities, targeting different tenant types (such as students, professionals, or families), or mixing property types (apartments, villas, multi-unit buildings).

MLS listings will remain your primary source of data and opportunity. By checking the platform regularly, staying updated on market trends, and learning from past purchases, you can make smarter decisions and grow your portfolio efficiently.

Property Management and Long-Term Success

Owning rental properties is a long-term commitment. Whether you self-manage or hire a property manager, it’s important to ensure your properties remain attractive to tenants, well-maintained, and compliant with local regulations.

You should track the performance of each property in your portfolio — including income, expenses, tenant turnover, and maintenance costs. This data helps you identify underperforming assets and plan future purchases more strategically.

Successful investors often reinvest profits into new properties, increasing their holdings year by year. With the right strategy and smart use of MLS data, your rental property portfolio can become a reliable source of income for life.

Multiple Listing Services Software Providers

Without Multiple Listing Services Software Providers, MLS platforms could not operate effectively. These providers enable agents to manage data and complete transactions smoothly.

Prominent international companies include CoreLogic Matrix MLS, Black Knight Paragon, FBS Flexmls, Rapattoni, and Bridge Interactive, which offer search, IDX, and mobile solutions.

ArabMLS is transforming real estate in MENA by delivering localized systems such as Egypt MLS, Dubai MLS, Saudi MLS, Qatar MLS, and Bahrain MLS, aligned with international practices.

This innovation ensures efficiency, accuracy, and credibility for regional property transactions.

Conclusion

Developing a rental property portfolio is one of the most practical and rewarding paths to financial security. It allows you to build wealth through both passive income and capital appreciation. However, success in this field depends on informed decisions, careful planning, and continuous learning.

By using MLS listings effectively, you gain access to a wealth of data that can guide every stage of your investment journey — from finding your first property to expanding your holdings across multiple markets.

For Arab investors with a long-term vision, real estate remains a powerful vehicle for building generational wealth. And with modern tools like the MLS, the process is more accessible and data-driven than ever before.

Start small, stay consistent, and always make informed decisions. Your rental property portfolio will grow — and so will your financial freedom.