In today’s dynamic real estate and financial landscape, technology plays a crucial role in bridging information silos and enabling smarter decisions. One such transformative integration is between Multiple Listing Service (MLS) data and financial planning tools. Traditionally used by real estate professionals to manage property listings, MLS data offers a rich repository of real-time and historical housing market information. By integrating this data into financial planning platforms, advisors and individuals gain a holistic view of assets, liabilities, and market trends—leading to more informed, strategic financial decisions.

This article explores the benefits, challenges, and use cases of integrating MLS data with financial planning tools, offering insights into how this convergence can revolutionize wealth management.

The Value of MLS Data in Financial Planning

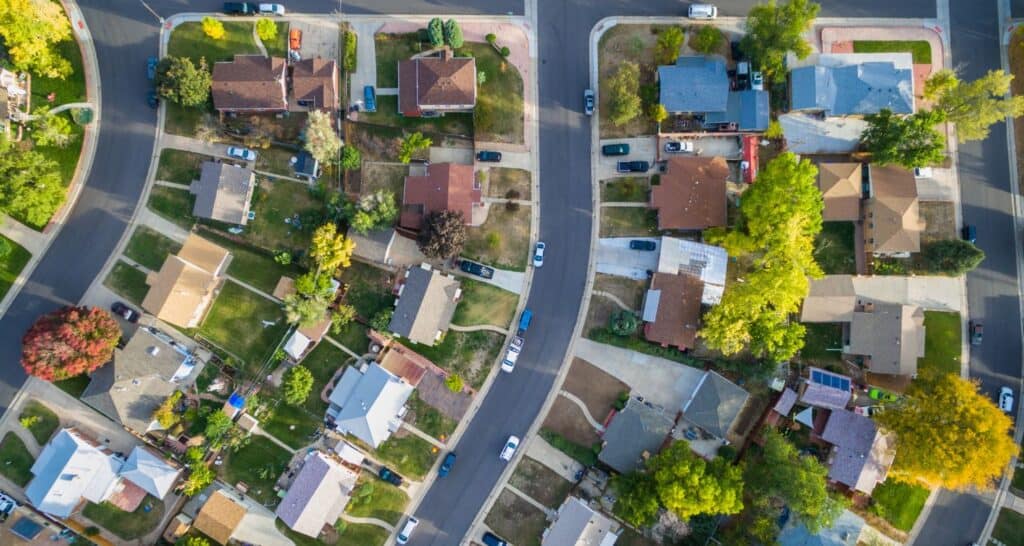

MLS systems provide detailed, up-to-date property information including:

-

Listing prices and history

-

Property characteristics (size, location, amenities)

-

Comparable sales (comps)

-

Market trends and average days on market

-

Regional price appreciation or depreciation patterns

Financial planning, on the other hand, relies on accurate asset valuation, future cash flow projections, and long-term goals to build actionable plans. Real estate is often the largest asset class in a client’s portfolio, yet it is frequently undervalued or based on outdated estimates.

By integrating MLS data, financial planners can:

-

Enhance Net Worth Accuracy: Instead of relying on static home value estimates or owner-reported figures, planners can access real-time market-based valuations.

-

Forecast Investment Performance: Historical and trending data allow planners to estimate future value appreciation, rent yields, and return on investment for real estate holdings.

-

Improve Asset Allocation: With clearer insights into real estate’s share of the total portfolio, planners can recommend better asset diversification strategies.

-

Assist in Real Estate Decision-Making: For clients considering buying, selling, or refinancing, MLS data supports evidence-based scenario modeling.

Use Cases of MLS-Financial Planning Integration

Dynamic Net Worth Tracking

Traditional financial tools often rely on manual input or third-party aggregators to track home equity. With MLS integration, valuations can be automatically updated based on actual market data. This helps in maintaining accurate balance sheets and tracking changes over time due to both principal paydown and market appreciation.

Scenario Analysis for Real Estate Decisions

Clients looking to downsize, relocate, or invest in a second home can benefit from side-by-side property comparisons, local market trends, and sale timing strategies. Financial advisors can simulate scenarios such as: “What happens if we sell the primary residence in 5 years and relocate to a lower-cost market?”

Tax Planning and Capital Gains Management

MLS data supports estimation of current market value against purchase price, helping advisors model capital gains liabilities. Combined with financial planning tools, they can suggest optimal sale timelines or 1031 exchange strategies to mitigate tax burdens.

Mortgage and Refinance Analysis

By cross-referencing current market value with existing mortgage terms, advisors can recommend optimal refinance options or assess borrowing potential for other investments or cash flow needs.

Technical Aspects of Integration

APIs and Data Feeds

Many MLSs offer access via APIs or syndicated data feeds. Platforms like CoreLogic, Black Knight, and Realtor.com provide programmatic access to comprehensive property databases. These can be integrated into planning tools through secure RESTful APIs that support automated data ingestion and synchronization.

Real-Time vs. Periodic Updates

Depending on the financial planning tool’s design, data can be pulled in real-time (for client-facing dashboards) or updated periodically (e.g., weekly or monthly snapshots). Real-time access is ideal for advisors involved in active real estate consulting.

Standardization and Data Normalization

MLS data is notoriously non-standardized across regions. Tools must normalize data to align property attributes and pricing metrics, ensuring consistency when rolled up into planning dashboards.

Benefits to Financial Advisors and Clients

For Advisors:

-

Differentiation: Offering real estate insights positions advisors as comprehensive wealth managers, not just investment planners.

-

Client Retention: Real estate decisions often involve significant emotion and capital. Advisors who help navigate these decisions build stronger client relationships.

-

New Revenue Streams: Integrated tools can offer upselling opportunities—premium planning tiers, RE investment consulting, or affiliate services like mortgage brokerage.

For Clients:

-

Clarity and Confidence: Understanding real estate’s impact on long-term goals empowers clients to make smarter decisions.

-

Convenience: Fewer platforms and manual updates lead to a more seamless planning experience.

-

Proactive Strategy: Clients are better positioned to act on opportunities or risks in their housing market before they become critical.

Challenges and Considerations

While the potential is significant, integrating MLS data into financial planning platforms comes with hurdles:

-

Licensing Restrictions: Many MLSs restrict data use to members or specific licensed applications. Financial tools must negotiate partnerships or access through licensed third parties.

-

Data Accuracy and Privacy: Property data may have inconsistencies or require updates. Also, maintaining client privacy when using third-party data sources is essential.

-

Market Fragmentation: Over 600 MLSs exist in the U.S. alone, each with its own structure and access policies. Nationwide integration requires either aggregation partners or a scalable data pipeline.

-

User Interface Complexity: Visualizing real estate data alongside traditional financial metrics requires thoughtful UX design to avoid overwhelming users.

The Future of Integrated Financial Ecosystems

The convergence of MLS and financial data reflects a broader trend toward personalized, tech-enabled wealth management. As clients demand a 360-degree view of their financial lives, tools that unify disparate data sources—like real estate and investments—will become essential.

In the future, we can expect financial planning tools to not only integrate MLS data but also leverage AI to deliver:

-

Predictive Market Alerts (e.g., “Your home’s value has increased 15%—consider refinancing.”)

-

Real-Time Opportunity Matching (e.g., “This property matches your investment goals.”)

-

Automated Equity Optimization (e.g., “Tap into your home equity to fund college expenses.”)

Conclusion

Integrating MLS data with financial planning tools is more than a technological upgrade—it’s a strategic enhancement that elevates the quality of financial advice and client engagement. By bridging the gap between real estate and personal finance, advisors and platforms can provide deeper insights, unlock hidden value, and guide clients toward smarter, more holistic financial decisions.

As data access improves and client expectations rise, this integration will likely become a standard offering in modern wealth management platforms. Early adopters—both in technology and advisory services—will stand to gain a competitive edge in a rapidly evolving marketplace.

Frequently Asked Questions

What is MLS data, and why is it important for financial planning?

MLS stands for Multiple Listing Service, which is a database used by real estate professionals to list and find properties for sale or rent. It includes detailed information such as listing prices, property features, sale history, and market trends. MLS data is important for financial planning because real estate often represents a major part of an individual’s wealth portfolio. Accurate, up-to-date property valuations from MLS data help financial planners and clients understand the true value of real estate assets. This enables better net worth tracking, informed investment decisions, and more accurate cash flow and tax planning.

How does integrating MLS data improve the accuracy of a financial plan?

Integrating MLS data improves accuracy by providing real-time or near real-time property valuations based on actual market transactions, rather than relying on outdated estimates or self-reported values. This dynamic valuation accounts for recent sales in the neighborhood, price trends, and property specifics, offering a more precise picture of the client’s real estate assets. Accurate asset values mean the entire financial plan—from net worth calculations to retirement projections—reflects the current market reality, allowing for better risk management and goal setting.

What technical challenges exist when integrating MLS data with financial planning software?

There are several technical challenges to consider:

-

Data Standardization: MLS data formats vary significantly across different regions, so the data must be normalized to create consistent, comparable inputs.

-

Access Restrictions: MLS databases often have strict licensing rules limiting who can access or redistribute the data. Financial platforms need proper agreements or use third-party aggregators.

-

Data Volume and Updating: Managing and syncing large datasets requires efficient infrastructure. Deciding between real-time updates versus periodic batch imports affects system design and user experience.

-

Privacy and Security: Protecting sensitive client data while using third-party property data sources requires strong encryption and compliance with data protection laws.